The most recent data released by Cox Automotive, in an August 1st report, measured total inventory levels currently available to be 2.79m generating an estimated 68 day supply based on the previous 30 day rate.

They also indicated the average list price of a New Vehicle is $47,307 which is $159 lower than the same time last year.

As we change gears and head over to news @ CarEdge, a leading Consumer Automotive Informational Hub, the data tells a similar story.

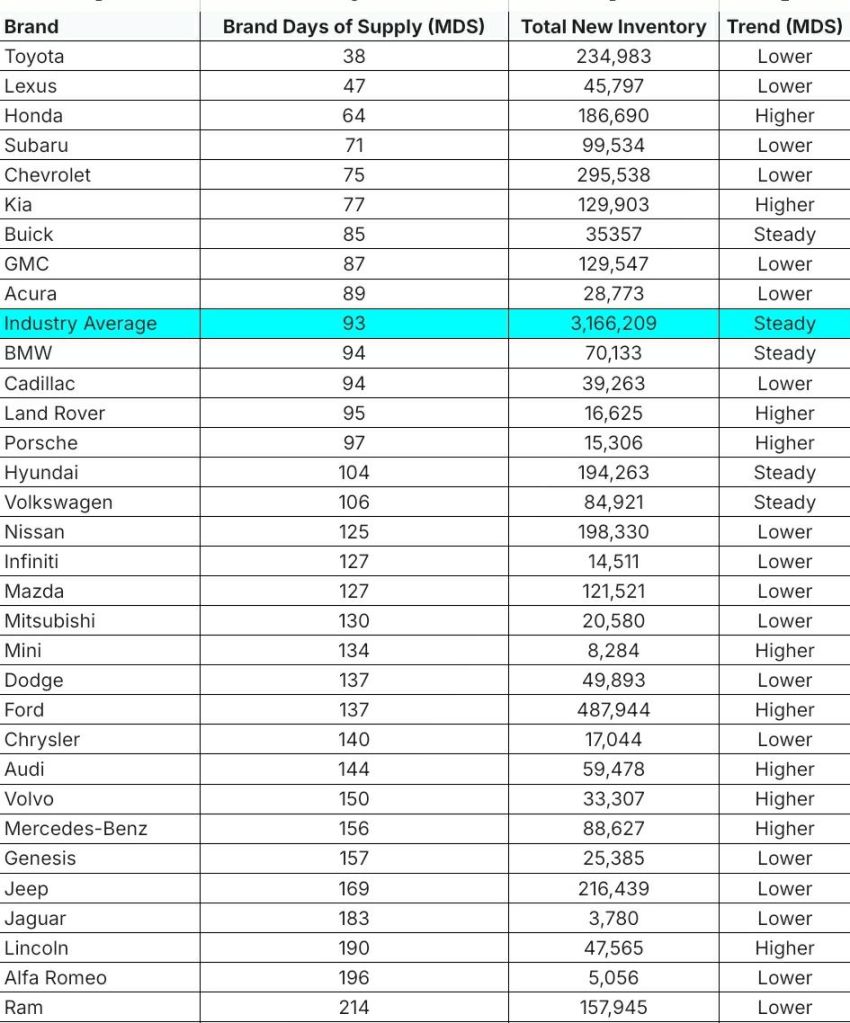

What we will reference as Total New Inventory for the Nation as defined above, takes us to a 93 Day Supply, per CarEdge Insights for the month starting September 1 2024.

The provided data just screams at me, it tells me we can inference from the data:

- Stellantis is in the overwhelmingly worst position with 30% of its inventory still being stuck in 2023 and disastrous quarterly earnings reports revealing a staggering 48.51% decline in net income YoY.

- Ford is having issues of its own under the hood, as evidenced by its increasing Day Supply for both Ford and Lincoln. Its latest quarterly earnings report led to the single largest 1 day drop for its stock since 2008 at an 18.4% decline.

- Toyota is still king of the road as it dominates the competition by outpacing not only in volume, but also having Day Supply 30%-40% far lower than the closest brand, even with the second most units on the ground overall

I appreciate you reading this article, and encourage you to engage with me not only here but also on social media. Thanks for the support, and until next month ✌

Leave a comment