This Audio above is a Podcast style, AI Audio Overview of the Article you will be reading, it is not a line by line narration, but rather more content for you to enjoy!

When the CEO of the most powerful bank in the world gives a warning, you listen. When asked this week about the back-to-back collapses of automotive players Tricolor and First Brands, JPMorgan’s Jamie Dimon was blunt, immediate, and ominous. “When you see one cockroach,” he said, “there’s probably more.”

From our desk here in Daytona Beach, we can confirm his warning was not hyperbole. It was a diagnosis. The failures that have rocked the auto sector are not isolated events. They are the first tremors of a systemic crisis, the first cockroaches scurrying into the light. This is not a story about car parts and subprime loans. This is an exposé on the unregulated, multi-trillion-dollar world of shadow banking that has festered in the dark for a decade, and whose implosion is now threatening to spread a dangerous contagion through the American financial system.

This investigation will reveal the catastrophic conflict of interest that trapped the investment bank Jefferies, the brilliant and predatory shadow bet that positioned the private equity giant Apollo to profit from the chaos, and how the automotive world became the unwilling stage for a crisis that was born in the deepest shadows of Wall Street.

Start Your Research Here

The ‘A’ in A.S.M.R. is for Automotive. This is your toolkit for becoming a smarter buyer.

The Anatomy of a Conflict

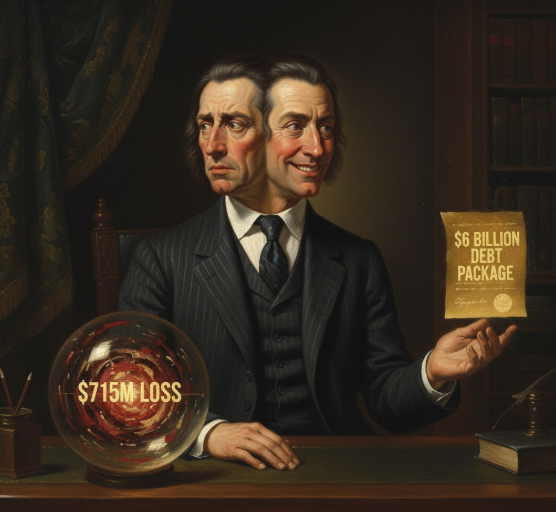

Jefferies’ $715 Million Trap

To understand the rot at the core of the First Brands collapse, you must understand the impossible position of the investment bank Jefferies. They were not merely a lender; they were a primary architect of the very financial machinery that blew up, and they were caught in a brutal, self-inflicted trap.

On one hand, Jefferies was a massive creditor, with a staggering $715 million of its own capital directly at risk in an off-balance-sheet fund tied to First Brands. This fund was essentially a bet on the company’s health. If First Brands thrived, Jefferies would profit handsomely. If it collapsed, their investment would be wiped out.

On the other hand, Jefferies’ investment banking division was simultaneously trying to raise $5.2 billion in new, high-risk “private credit” debt for First Brands. This is a catastrophic conflict of interest. They were using their reputation to sell new, risky debt to the market, while having a vested, secret interest in keeping the company alive long enough to save their own $715 million skin. They weren’t just a passenger on a sinking ship; they were the ones trying to sell tickets for the next voyage, knowing full well the iceberg was dead ahead. This conflict is the smoking gun that proves the system was compromised from the inside.

Own It Right.

The ‘M’ is for Maintenance. Find your vehicle’s official factory service schedule.

The Smart Money’s “Tell”

Apollo’s Shadow Bet

If Jefferies represents the conflict at the heart of the crisis, the private equity firm Apollo Global Management represents the cold, calculating intelligence that saw the collapse coming and positioned itself to profit from it. Apollo, like Jefferies, was also a major creditor to First Brands. But unlike Jefferies, they were playing a brilliant and ruthless double game.

While publicly holding a position as a lender, Apollo was privately making a massive bet against the company’s ability to survive. Because First Brands was a private company and its loans were blacklisted from normal trading, Apollo couldn’t simply short the stock. Instead, they went into the dark world of shadow finance and used custom credit default swaps. This complex financial instrument was, in its simplest terms, an insurance policy that would pay out an unknown but likely lucrative amount of money, that would be well worth it, if First Brands defaulted. It was effectively a short position.

This is the ultimate “tell.” Apollo, one of the most sophisticated financial players on the planet, had a unique inside view of the company’s fragile financial state. They saw the cockroaches long before anyone else. And instead of running for the exit, they bought insurance and then calmly waited for the house to burn down, knowing they would be the ones to cash the check.

The Contagion

From Cockroaches to a Colony

This crisis is no longer contained to the auto industry. The fear is now spreading, and the hard data proves it. In a single day this week, the SPDR S&P Regional Banking ETF (KRE), a key index that tracks the health of America’s regional banks, plunged over 6%. Wall Street is panicking, terrified that the contagion of hidden debt and risky commercial loans is not isolated to a few bad actors, but is endemic throughout the regional banking system.

The unifying theme behind this entire crisis is the end of an era. For over a decade, the Federal Reserve’s policy of near-zero interest rates created a paradise for debt. It allowed risky companies like Tricolor and over-leveraged private equity empires like First Brands to borrow trillions with little consequence. It fueled the entire shadow banking ecosystem. Now, that era is definitively over. With interest rates high, these companies can no longer afford to service or refinance their gargantuan mountains of debt. The cheap money that fueled the party has been taken away, and the financial system is now convulsing through a painful and violent withdrawal.

The Light Comes On

Jamie Dimon was right. The lights have been turned on after a decade-long party in the dark, and we are finally seeing the cockroaches for what they are: a systemic infestation. The collapses in the automotive world were not the cause of this crisis; they were merely the first, most visible symptoms of a sickness that has been festering deep inside the unregulated world of shadow finance.The story of Jefferies’ conflict of interest and Apollo’s predatory foresight is the story of a system that has been allowed to operate without scrutiny for far too long. The great unwinding of this debt is just beginning. The “Great Squeeze“ has claimed its first corporate victims. Jamie Dimon warned us to look for more. We will.

Based in Daytona Beach, Florida, Josh Logan provides data-driven analysis from the unique perspective of a seasoned automotive professional. His goal is to empower consumers with insider knowledge to navigate the complexities of the modern car market.

I appreciate you reading this, and encourage you to engage with me in the comments and on social media. You can get the latest automotive updates as soon as they are published by subscribing above. Thanks for the support, and until next time!

Leave a comment