This Audio above is a Podcast style, AI Audio Overview of the Article you will be reading, it is not a line by line narration, but rather more content for you to enjoy!

The Good News?

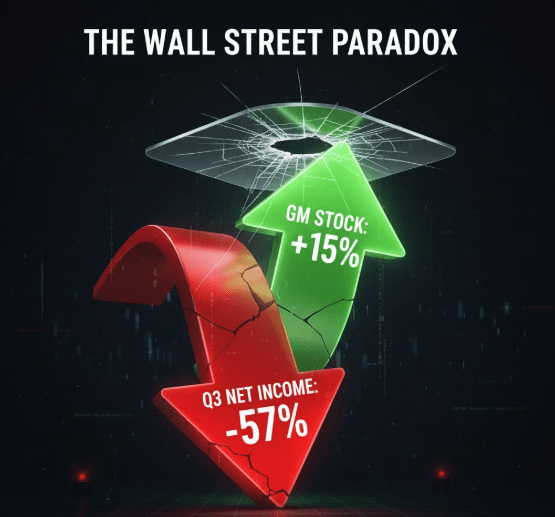

GM stock popped 17% from yesterday’s close of markets, and finished the day up almost 15% today after the Quarterly Earnings Report.

The Real Story?

The numbers are in from Detroit, and they are a shock to the system. General Motors’ third-quarter earnings were released this morning, and the headline figure is a body blow: net income plummeted by a staggering 57% year-over-year.

The company was quick to name the culprit. In their official filings, they pointed to a single, massive $1.6 billion “special charge” related to “EV portfolio actions.” But as we’ve learned from over a decade in this business, the headline is rarely the full story. From our desk here in Daytona Beach, we’ve torn the report apart, and the data reveals a far more complex and troubling narrative.

This Q3 report exposes the central, agonizing conflict at the heart of General Motors. It’s a story of a legacy business—gas-powered trucks and SUVs—that is still printing cash, being forced to fund a future (EVs) that is proving to be incredibly expensive and complex to navigate.

But the real story, the one hidden beneath the EV write-downs, is one of a relentless, multi-billion-dollar financial assault from tariffs. The EV charge is the story GM wants to tell; the tariff math is the story the numbers actually prove.

Start Your Research Here

The ‘A’ in A.S.M.R. is for Automotive. This is your toolkit for becoming a smarter buyer.

The $1.6 Billion Bombshell

First, let’s analyze the headline. A $1.6 billion write-down is not a rounding error; it is a stunning admission of a major strategic failure. This charge, which GM vaguely labels as “EV portfolio actions,” is corporate-speak for a massive and costly cleanup of past decisions.

Here is the top-line data that frames the crisis:

| Metric | Q3 2025 | Q3 2024 | Year-over-Year Change |

| Net Income | $1.327 Billion | $3.056 Billion | -57% |

| EBIT-Adjusted | $3.376 Billion | $4.115 Billion | -18% |

| Revenue | $48.591 Billion | $48.757 Billion | -0.3% |

| EV Restructuring Charge | ($1.6 Billion) | N/A | N/A |

Source: General Motors Q3 2025 Earnings Report

While GM’s leadership won’t detail every line item, our experience in “The Box” tells us exactly what this means. This is the sound of a company slamming the brakes on its own strategy. This is the cost of canceling a planned EV model that was already in development. This is the sound of writing nine-figure checks for penalties to suppliers for battery and component contracts that are now worthless.

This is not a one-time fluke. This is a tangible, brutal symptom of the immense difficulty and cost of navigating the EV transition in real-time. With a hostile administration, expiring EV tax credits, and a government that seems at war with its own manufacturers, the path forward is a minefield. This $1.6 billion is the cost of stepping on the first mine.

Own It Right.

The ‘M’ is for Maintenance. Find your vehicle’s official factory service schedule.

The Real Math

How Tariffs Are Gutting the Bottom Line

The EV charge is damaging, but it’s also a convenient scapegoat. When you dig into the year-to-date numbers, a much larger and more insidious villain emerges: tariffs.

GM wants to frame its profit slide around the EV transition, but let’s do the real math. Let’s look at the company’s performance for the first nine months of the year:

- 9-Month Net Income (2025 vs. 2024): $6.007 Billion down from $8.969 Billion

- 9-Month EBIT-Adjusted (2025 vs. 2024): $9.903 Billion down from $12.424 Billion

The year-over-year drop is a massive $2.96 billion in Net Income and $2.52 billion in EBIT-Adjusted. Where did that money go? The company itself has stated that the estimated full-year hit from tariffs will be between $3.5 billion and $4.5 billion.

That is the exact math, and that is the real problem. The entire year-over-year profit deficit—every single dollar—can be explained by the relentless financial drain of these tariffs. If GM didn’t have this multi-billion-dollar anchor tied around its ankle, this would be a “normal year.” The EV transition is a challenge, but the tariff war is a catastrophic, nine-figure bleed that is gutting the company’s profitability from the inside out.

The EV Profitability Paradox

Even as GM takes a massive write-down on its EV plans, it is simultaneously trying to convince Wall Street that its EV program is on the verge of success. The key phrase used on the earnings call was that its EVs are “variable profit positive.”

This is another piece of corporate-speak that we must translate for consumers. “Variable profit positive” simply means the direct cost of the battery, steel, and labor is less than the sale price of the car. It specifically excludes the billions spent on R&D, the billions to build the factories, and the hundreds of millions in marketing.

In short, they aren’t losing money on the parts, but they are almost certainly still losing massive amounts of money on the program. GM’s entire future North American profit strategy relies on scaling this program to the point where it becomes truly contribution-margin positive, meaning it actually helps pay for the lights and the engineers. This report proves what a dangerous high-wire act that is.

The ICE Engine That Still Runs

So, with billions being burned on EV missteps and billions more being seized by tariffs, how is the company still standing? The answer is simple: the internal combustion engine (ICE).

The core, “legacy” business of selling gasoline-powered trucks and SUVs, particularly in North America, remains a fortress of profitability. The Silverado, the Tahoe, the Suburban—these are the high-margin cash-printing machines that are paying all the bills. They are funding the EV transition, offsetting the tariff losses, and keeping the entire enterprise afloat.

This is the central, agonizing conflict at the heart of GM. It is being forced to starve its profitable past in order to feed its uncertain, expensive, and politically volatile future. That is the definition of the “Great Squeeze.“

A War on Two Fronts

This earnings report is a sobering, data-driven reality check. General Motors is fighting a war on two fronts, and the Q3 numbers are the first clear receipt for just how much that war costs.

On one front, they are navigating a messy, expensive, and volatile transition to an all-electric future—a transition that just cost them $1.6 billion in a single quarter. On the other front, they are weathering a relentless financial assault from a government that seems at war with its own industry, with tariffs draining billions from their bottom line.

The road to the future is not a smooth, clean line. It is a chaotic and costly process. GM has shown its hand, revealing the deep financial wounds from this fight.

On Thursday, we’ll see how its crosstown rival, Ford, is navigating the same treacherous road.

Based in Daytona Beach, Florida, Josh Logan provides data-driven analysis from the unique perspective of a seasoned automotive professional. His goal is to empower consumers with insider knowledge to navigate the complexities of the modern car market.

I appreciate you reading this, and encourage you to engage with me in the comments and on social media. You can get the latest automotive updates as soon as they are published by subscribing above. Thanks for the support, and until next time!

Leave a comment