Author: Josh Logan

-

The Shadow Contagion: Flying Blind (Nov. 2, 2025)

In this gripping episode of “Confessions of an Insider,” we unravel the profound turmoil hidden beneath the surface of the auto finance industry, challenging the misleading narratives spun by the latest ACEA report. As Tesla falters and the NDFI “Shadow Contagion” threatens major banks, we expose the chaotic reality shaping our future.

-

FLYING BLIND: The NDFI “Shadow Contagion” & The Big Banks’ Hidden Exposure

While Wall Street celebrates misleading headlines, the European auto market collapses, revealing a looming “Shadow Contagion.” With Tesla’s staggering -39% drop and Ford’s alarming loan loss provision, the truth is stark—systemic risks lurk in shadow banks linked to major financial institutions, threatening the entire economy. Wake up before it’s too late.

-

BREAKING ANALYSIS: Europe’s 10% Jump Masks a Market Flying Blind as Tesla Collapses 38.7%

The European auto market may appear to thrive with a 10% September boost, yet it conceals a disheartening reality—core markets are shrinking, and traditional engines are collapsing. Consumers are gravitating towards hybrids instead of pure electric vehicles. Amidst this chaos, Tesla’s dramatic decline contrasts with China’s BYD surging, redefining industry dynamics.

-

The Great Tariff Deception (Oct. 26, 2025)

This episode of Confessions of an Insider unveils the harsh realities behind the latest earnings reports from the auto giants. While Wall Street rejoices, GM obscures its tariff losses, and Ford braces for consumer chaos. The “Great Squeeze” and the “Domino Effect” are no longer mere theories but undeniable truths reshaping Detroit’s landscape.

-

The Great Tariff Deception — How GM and Ford Proved the Squeeze is Here

In a shocking revelation, Detroit’s titans, GM and Ford, illustrate the dire state of the auto industry amid a tariff crisis. GM masked a $3.5 billion profit hole with a $1.6 billion EV charge, while Ford laid bare the brutal truth of a $1 billion guidance cut. The consumer crisis looms ominously, yet Wall Street…

-

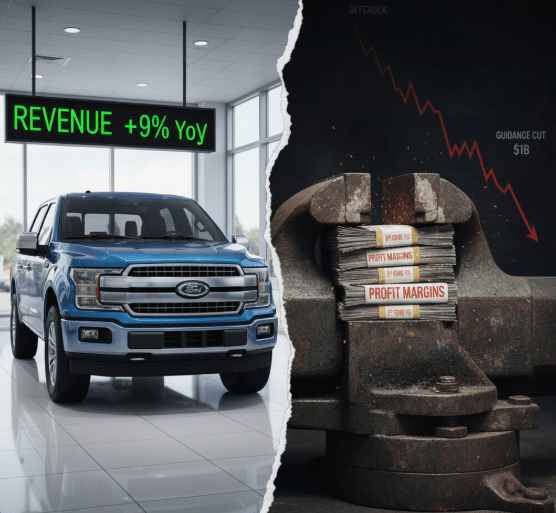

BREAKING ANALYSIS: Ford Q3 Revenue Beat Masks Tariff Pain as Loan Loss Fears Explode

Ford’s third-quarter report reveals a troubling reality beneath its seemingly strong revenue, with profits plummeting and a billion-dollar guidance cut due to crippling tariffs. As consumer loan defaults loom large, the data signals a significant crisis ahead. Wall Street’s optimistic reaction starkly contrasts the underlying distress facing both the company and its customers.

-

BREAKING ANALYSIS: September CPI Confirms the “Great Squeeze” Tightens Its Grip on Car Owners

In a world of celebratory inflation headlines, reality bites hard for American car owners. The September CPI report reveals that while overall inflation hovers at 3.0%, essential car-related costs are soaring, squeezing consumers relentlessly. This “Great Squeeze” exposes the facade of relief—data-driven misery is the true reality lurking beneath.

-

The Domino Effect: Primalend Collapse Shows Even “Honest” Auto Lenders Are Breaking

The auto finance sector is shuddering as PrimaLend Capital Partners files for Chapter 11 bankruptcy, marking the third major collapse in weeks. Unlike the previous fraud-driven failures, PrimaLend’s demise highlights an alarming reality: even legitimate businesses cannot withstand the brutal economic squeeze. The “Domino Effect” is real, and the crisis deepens. Who’s next?

-

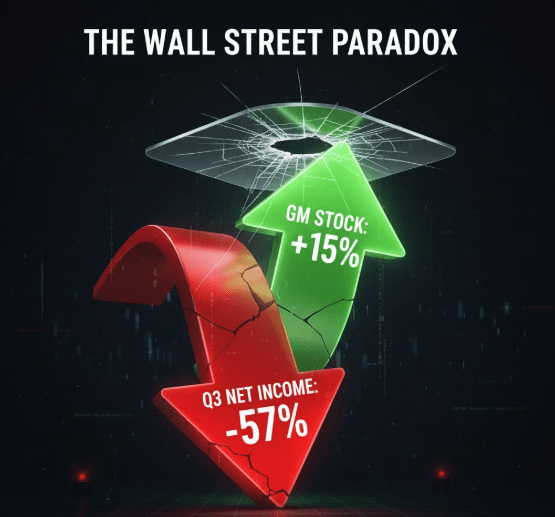

BREAKING ANALYSIS: GM Profits Plunge Over 50% on a Massive $1.6 Billion “EV Restructuring” Charge

General Motors is caught in a brutal financial squeeze. While the company seeks to spin a $1.6 billion EV write-down as the core issue, the real villain is the staggering toll of tariffs, draining billions. As legacy profits fund an uncertain electric future, GM grapples with mounting losses—revealing the painful cost of transition.