Category: Automotive Data

-

BREAKING ANALYSIS: PPI Report Shocks with a Drop, But Key Auto Costs Tell a Different Story

In a deceptive twist, while the Producer Price Index hints at economic relief, the auto industry remains mired in relentless cost pressures. The “Great Squeeze” persists, with rising raw material prices decimating profit margins. Brace yourself—no discounts in sight. Automakers will shift focus to high-margin offerings at your expense.

-

A Deceptive Calm: Used Car Prices Hold Steady in August, But a Rental Fleet Surge is Propping Up the New Car Market

The wholesale used vehicle market may appear stable, but it’s merely a facade. A surge in fleet sales, driven by car rental companies, artificially inflates new car figures, masking a declining consumer demand. As used car prices rise, a crisis looms—what will happen when this fleet-driven illusion fades?

-

BREAKING ANALYSIS: U.S. Auto Sales Defy Tight Inventory, Remain Strong at 16.1 Million Pace in August

The U.S. auto market for August showcases remarkable resilience with a 16.1 million SAAR, driven by soaring consumer demand despite dwindling inventory. Hybrids are dominating the scene, epitomizing the growth narrative of 2025. Yet, as sales rise, automakers grapple with soaring production costs, balancing profits amidst strong demand.

-

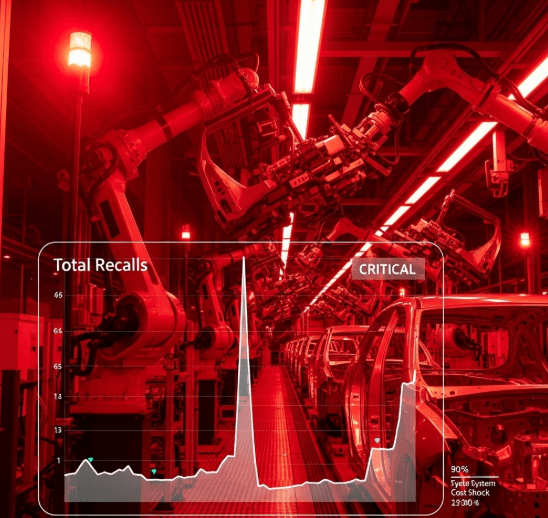

Recalls by the Numbers: Ford’s Crisis Worsens with 1.4M Vehicles Recalled in August Alone

Ford’s recall crisis has reached alarming heights, with 14 new campaigns affecting 1.4 million vehicles in August alone, driving their staggering recall-to-sales ratio to 401.5%. Meanwhile, Hyundai thrives with minimal recalls. The chasm between these brands signals a troubling reality for consumers and exposes the auto industry’s hazardous quality control failures.

-

New Car Supply Plummets, Risking a “Manufactured” Supply Crunch

The U.S. auto market is on the brink of disaster as new vehicle supplies plunge, echoing past crises. With demand soaring and used car prices skyrocketing, affordable options are vanishing fast. Buckle up—the race for cars has become a desperate FOMO nightmare where scarcity drives prices through the roof. Will you get left behind?

-

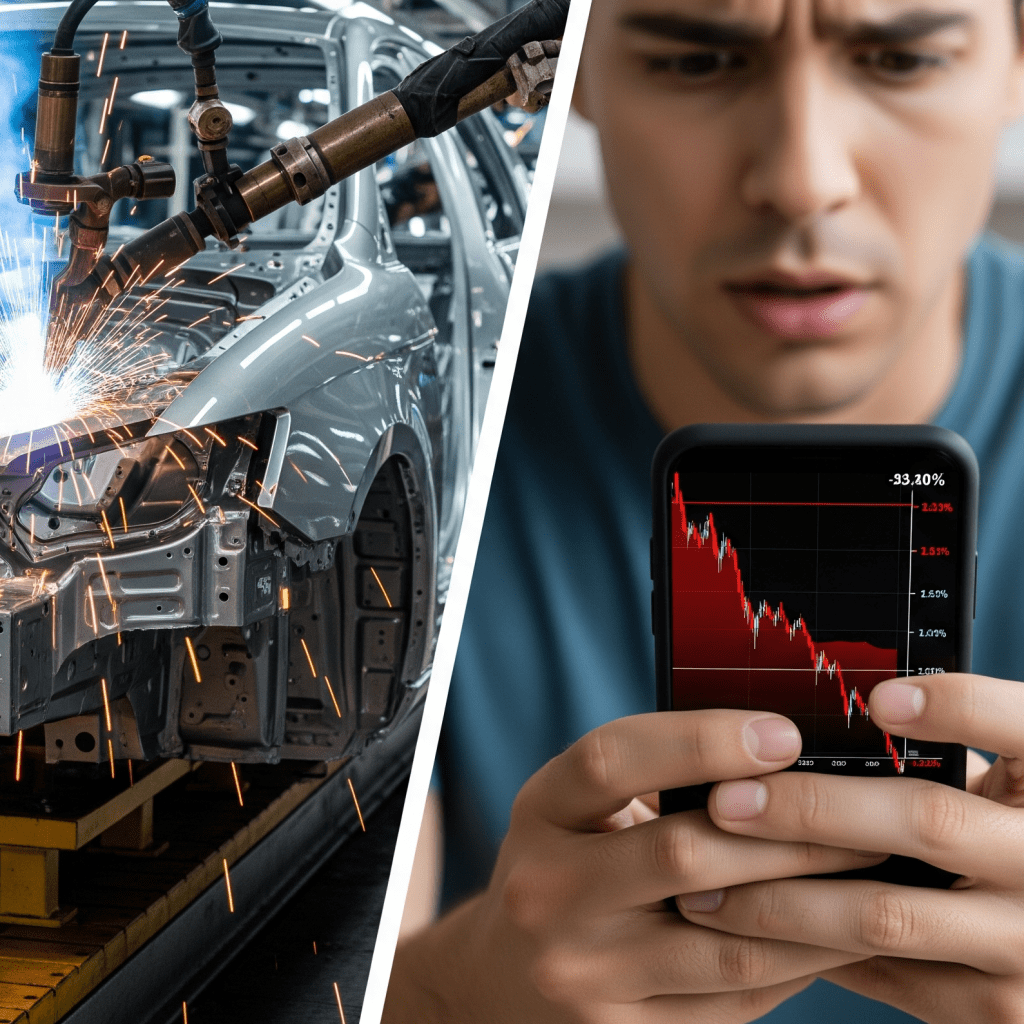

BREAKING ANALYSIS: Core Producer Prices EXPLODE – The Margin Crisis Intensifies

Just hours after we published our deep dive into the future of car buying and the complexities of the direct-to-consumer model, a major economic data release has dropped that throws the industry’s underlying challenges into stark relief: the Producer Price Index (PPI) for July has just been released, and the numbers are nothing short of…

-

BREAKING ANALYSIS: Auto Inflation Roars Back as Used Car and Insurance Prices Spike in July

This morning, the U.S. Bureau of Labor Statistics released the highly anticipated Consumer Price Index (CPI) report for July, showing headline inflation rose by 0.3% for the month and 2.7% over the last year. That’s the big-picture number you’ll see in the headlines, and it’s where the national political debate will live. But for our…

-

BREAKING ANALYSIS: July’s High Auto Sales Mask a Margin Crisis as Inventory Swells

IMMEDIATE ANALYSIS – The auto industry is reporting a strong 16.4 million seasonally adjusted annual rate (SAAR) for July, a headline that, in isolation, suggests a booming market. However, this top-line number is dangerously misleading. It conceals a deepening crisis for automakers: profits are collapsing under the weight of tariffs while unsold inventory is simultaneously…

-

Recalls by the Numbers: A Mid-Year Look at a Carmaker’s Toughest Metric

The 2025 mid-year recall analysis highlights significant disparities in automakers’ recall-to-sales ratios. Ford leads with 127.9%, indicating severe quality issues, while Tesla’s over-the-air recalls mitigate customer inconvenience. In contrast, Toyota and Honda maintain lower ratios of 20.0% and 18.7%, suggesting effective quality control. These figures emphasize auto industry safety challenges.

-

The Tariff Toll: Who’s Paying the Price for Auto Trade Wars in 2025?

As the books close on the first half of 2025, the U.S. auto industry is sending a clear and costly message: tariffs are taking a substantial bite out of the bottom line. While dealership lots remain busy, a look at the quarterly financial reports from the top-selling auto brands reveals a story of eroding profits…