For a century, an automaker’s power was measured by the roar of its engines. Today, it’s measured in gigawatts. The electric vehicle battery is the new engine, the new oil field, and the new geopolitical battleground all rolled into one. While consumers see the finished product in the showroom, the journey of the materials inside that battery pack is the most critical, high-stakes, and vulnerable part of the entire modern auto industry.

Understanding this supply chain is no longer an academic exercise; it’s essential to understanding why EVs cost what they do, where the industry is headed, and who will hold the power in the next generation of mobility.

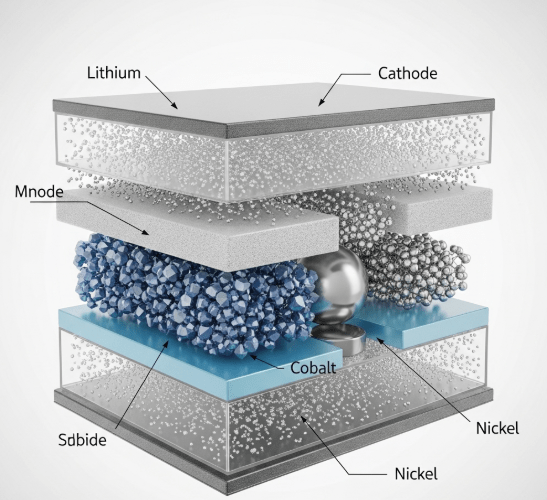

The Anatomy of Power:

What’s Inside the Black Box?

At its core, a modern EV battery relies on a few key minerals. The flow of these materials from mine to vehicle dictates the price, performance, and availability of every EV on the road.

- Lithium: The foundational element, acting as the primary medium for storing and releasing energy.

- Cobalt: Crucial for stabilizing the battery’s structure and preventing it from overheating, thus extending its life.

- Nickel: Used to increase the battery’s energy density, which translates directly to longer range.

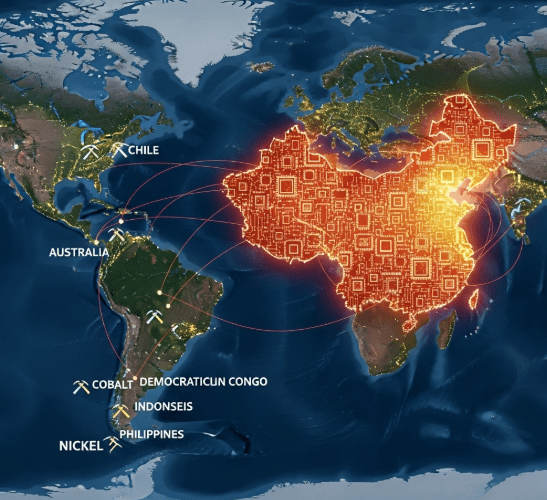

The Global Map of Power:

Mining vs. Manufacturing

This is where the geopolitical tension becomes crystal clear. The countries that mine the raw materials are often not the ones that hold the power. The real dominance comes from the refining and manufacturing process.

The EV Battery Supply Chain Breakdown:

| Material/Process | Primary Mining Locations | Dominant Refining/Processing Location |

| Lithium | Australia, Chile | China (60%) |

| Cobalt | DR Congo (70%+) | China (75%) |

| Nickel | Indonesia, Philippines | China (35%) |

| Battery Cell Mfg. | (Global) | China (78%) |

Source: Data synthesized from the International Energy Agency (IEA) and the U.S. Geological Survey (USGS).

This data reveals a stark reality: while raw materials are sourced globally, China has established a commanding dominance over the mid-stream processing and final manufacturing stages. This gives the nation immense leverage over the price and availability of the batteries that U.S. automakers are existentially dependent on.

The Cost Factor:

Why Your EV Price is Tied to Geopolitics

The battery isn’t just another component; it’s the single most expensive part of an electric vehicle.

- The Data: According to industry analyses, the battery pack accounts for 25% to 40% of the total cost of an EV.

- The Impact: This means that fluctuations in the price of lithium or cobalt, or any supply chain disruption due to geopolitical tensions, have a direct and massive impact on a vehicle’s final sticker price and the automaker’s already-thin profit margins. The “margin squeeze” we’ve analyzed in previous articles is directly linked to the high and volatile cost of these essential, foreign-controlled materials.

Source: Based on cost analysis from BloombergNEF and Goldman Sachs.

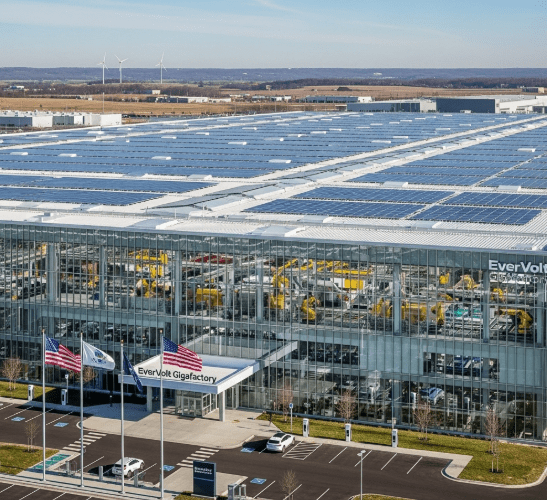

The “Onshoring” Race:

A Multi-Billion Dollar Scramble for Control

In response to this vulnerability, U.S. and allied automakers have launched a frantic, multi-billion-dollar race to bring battery production home. This “onshoring” of the supply chain is the single biggest industrial shift in decades.

- The Goal: To build massive “gigafactories” in North America to produce battery cells and assemble packs domestically, reducing reliance on Asia.

- The Players & Investments:

- Ford: Investing billions in its BlueOval City in Tennessee and battery parks in Kentucky and Michigan.

- General Motors: Rolling out its Ultium Cells joint venture with plants in Ohio, Tennessee, and Michigan.

- Stellantis: Partnering on gigafactories in Indiana and Ontario, Canada.

- Hyundai & Toyota: Also building major battery production facilities in the U.S. Southeast.

Source: Official automaker investment announcements and press releases.

The New Center of Gravity

The auto industry’s center of gravity has shifted from the oil fields of the Middle East to the mineral mines of Africa and the refining facilities of Asia. For the next decade, the success of Ford, GM, Nissan, and every other major automaker will not be determined by their marketing prowess, but by their ability to secure a stable, affordable, and politically reliable supply chain for their batteries. The race is on, and the winner will not just lead the car market—they will hold a significant lever of global power.

I appreciate you reading this article, and encourage you to engage with me not only here in the comments, but also on social media in the posts. You can get the posts as soon as they are published by subscribing below. Thanks for the support, and until next time!

Leave a comment