This Audio above is a Podcast style, AI Audio Overview of the Article you will be reading, it is not a line by line narration, but rather more content for you to enjoy!

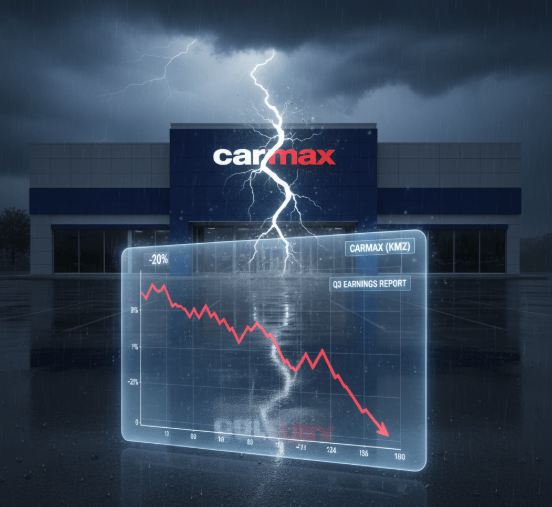

It is not an exaggeration to call this a shockwave. CarMax, the undisputed giant of the used car industry, a name synonymous with a streamlined, no-haggle process, has just delivered a catastrophic second-quarter earnings report. The market’s reaction was not one of mere disappointment; it was a brutal, swift verdict. A 20% freefall in the company’s stock price in a single morning is far more than a corporate stumble; it is the canary in the coal mine for the entire used car ecosystem.

This is not just a story about one company’s bad quarter. This is a story about the American consumer. The disastrous numbers coming out of CarMax—a staggering miss on profits, plummeting sales volumes, and a deeply alarming surge in money set aside for bad loans—reveal a customer base that is financially tapped out. The business model that revolutionized auto retail is now cracking under the immense pressure of the vehicle affordability crisis. This event is a critical escalation of our ongoing “Great Squeeze” narrative, and it signals a market teetering on the brink.

Based in Daytona Beach, Florida, Josh Logan provides data-driven analysis from the unique perspective of a seasoned automotive professional. His goal is to empower consumers with insider knowledge to navigate the complexities of the modern car market.

Dissecting the Disaster

The Numbers Don’t Lie

An earnings miss is one thing; a comprehensive failure of this magnitude is another. The data released by CarMax paints a grim picture of a business model cracking under immense pressure, with misses on nearly every key metric.

| Metric | Reported Figure | Wall Street Expectation | Result |

|---|---|---|---|

| Earnings Per Share (EPS) | $0.64 | $1.03 | Missed by 37% |

| Total Revenue | $6.59 Billion | ~$7.0 Billion | Missed by ~$400M |

| Retail Unit Sales (YoY) | -5.4% | (Varies) | Significant Decline |

| Comp. Store Sales (YoY) | -6.3% | ~+1.1% | Massive Miss |

| Wholesale Unit Sales (YoY) | -2.2% | (Varies) | Decline |

Source: CarMax Q2 FY2026 Earnings Release (Sept. 25, 2025)

A 37% miss on Earnings Per Share is a staggering failure of forecasting and execution. It shows that the headwinds facing the company were far stronger than anticipated. The nearly $400 million revenue shortfall and, most critically, the 6.3% decline in comparable store sales prove that this is a demand problem. Customers are not just hesitating; they are staying away in droves, even from the nation’s largest and most trusted retailer. As we’ve detailed in our previous deep dive, “The CarMax Machine,” this company’s entire model is built on massive scale and volume. A decline of this magnitude is a fundamental threat to its operational core.

The Most Important Number

The Loan Losses

Beneath the headline misses lies the most terrifying number in the entire report, a figure that should sound an alarm for the broader economy. CarMax Auto Finance (CAF) saw its income decrease by 11.2%, a drop driven by a 40% increase in the provision for loan losses.

Let’s be clear about what it means to have 142m set aside. This is money CarMax is being forced to set aside right now because it anticipates that a growing number of its own customers will be unable to pay back their car loans.

This is the hard, empirical evidence of the consumer credit strain we’ve been warning about in “The Great Squeeze.” It is the smoking gun. It proves that a significant number of Americans who purchased vehicles in the high-price environment of the last two years are now financially underwater and struggling to make their payments. This is not a theoretical risk; it is a present-day crisis unfolding within CarMax’s own multi-billion-dollar loan portfolio. This is a critical leading indicator of a coming wave of repossessions and loan defaults that will dump more inventory into a weakening market and put further downward pressure on used vehicle values.

Own It Right.

The ‘M’ is for Maintenance. Find your vehicle’s official factory service schedule.

The Blame Game

Tariffs, Prices, and a Tapped-Out Buyer

In the face of these disastrous results, CEO Bill Nash pointed to a “challenging quarter,” citing two primary factors. The first was a “pull forward” of demand in the first quarter, suggesting that consumer fears of new tariffs created an artificial sales boom that left a vacuum of demand in its wake. The second was the ongoing impact of vehicle depreciation on the company’s ability to price its cars competitively.

While these explanations certainly have merit, they feel like an attempt to describe a hurricane by focusing on the rain. The overarching, undeniable reality that connects every single data point in this report is the exhausted state of the American consumer. The problem is not that CarMax’s margins are off; their retail gross profit per unit held steady at $2,216. The problem is a fundamental lack of buyers who can afford the product.

The toxic combination of historically high vehicle prices and the Federal Reserve’s campaign of interest rate hikes has created an affordability crisis. Even as CarMax’s average selling prices have dipped slightly, it is not nearly enough to bridge the gap for a consumer being squeezed from every direction. The core issue isn’t a tariff announcement from three months ago; it’s the financial health of the buyer today.

A Harbinger of What’s to Come

CarMax is not just another company on the S&P 500. As the largest and most data-rich used vehicle retailer in the nation, its performance is a powerful macro-economic signal. Their pain is a direct reflection of the pain being felt across the entire sector, from the massive franchise dealers here in Daytona Beach to the small independent lots in every town across the country.

For the average person, the implications are twofold. In the medium term, this level of demand destruction will almost certainly lead to falling used car prices, offering some relief to buyers who have been patiently waiting on the sidelines. However, the surge in loan defaults will also mean a predictable tightening of credit standards, making it harder for those with less-than-perfect credit to secure financing.

The story of CarMax’s implosion is the story of a tipping point. It is the moment when the abstract concepts of inflation, interest rates, and consumer sentiment become a concrete, 20% collapse in market value. The CarMax machine has stalled, and it’s sending a clear warning to the entire auto industry: the consumer affordability crisis has reached a dangerous new phase, and the aftershocks are just beginning.

I appreciate you reading this, and encourage you to engage with me in the comments and on social media. You can get the latest automotive updates as soon as they are published by subscribing above. Thanks for the support, and until next time!

Leave a reply to TheLoganZone Insider Report: September 2025 – TheLoganZone Cancel reply