This Audio above is a Podcast style, AI Audio Overview of the Article you will be reading, it is not a line by line narration, but rather more content for you to enjoy!

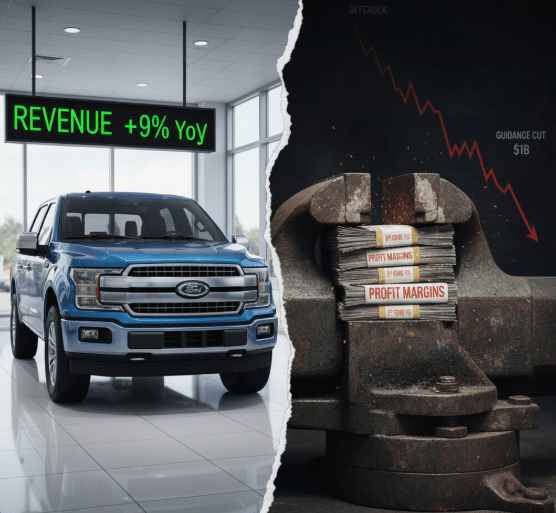

At first glance, Ford’s third-quarter earnings report, released yesterday, looks like a solid win. The company posted a strong revenue beat, with the top line growing an impressive 9% to $50.5 billion. But from our desk here in Daytona Beach, we’ve learned to never trust the headline. When you look past the revenue mirage, the data paints a grim and familiar picture: one of a company being aggressively hollowed out from the inside.

While sales were up, profits remain severely compressed, with year-to-date Adjusted EBIT down a massive $2.4 billion from last year. The pressure has become so intense that Ford was forced to make a significant cut to its full-year profit guidance, a clear strategic retreat.

This report is a data-driven confirmation of the “Great Squeeze“. But the most alarming signal isn’t just the profit crunch; it’s a terrifying spike in Ford Credit’s provision for loan losses. This is Ford’s own internal data showing they are bracing for a wave of consumer defaults. In a stunning disconnect, Wall Street ignored this, sending the stock soaring. Today, we’ll show you the data they’re choosing to ignore.

The Revenue Mirage & Guidance Cut

The Q3 report is a classic case of a revenue mirage hiding deep structural weaknesses. While the $50.5 billion in revenue looks great, the profit metrics tell the real story. Adjusted EBIT was flat, and Adjusted EPS actually declined year-over-year.

The real damage is visible in the year-to-date (YTD) numbers. Ford’s 9-month net income has fallen from $4.1 billion last year to just $2.9 billion in 2025.

Here is the data that frames the entire story:

Table 1: Ford Q3 & YTD Headline Performance (2025 vs. 2024)

| Metric | Q3 2025 | Q3 2024 | 9-Mo YTD 2025 | 9-Mo YTD 2024 |

|---|---|---|---|---|

| Revenue | $50.5 Billion | $46.2 Billion | $141.4 Billion | $136.8 Billion |

| Net Income | $2.4 Billion | $0.9 Billion | $2.9 Billion | $4.1 Billion |

| Adjusted EBIT | $2.6 Billion | $2.6 Billion | $5.7 Billion | $8.1 Billion |

| Adjusted EPS | $0.45 | $0.49 | $0.96 | $1.46 |

Source: Ford Motor Company Q3 2025 Report

Start Your Research Here

The ‘A’ in A.S.M.R. is for Automotive. This is your toolkit for becoming a smarter buyer.

This sustained profit collapse forced the company’s hand. Ford announced it is cutting its full-year Adjusted EBIT guidance from a high of $7.5 billion down to a new, lower range of $6.0 to $6.5 billion. This isn’t a minor adjustment; it’s a billion-dollar admission that the external cost pressures are relentless and overwhelming.

The Tariff Toll Confirmed

So, what is the “external pressure” responsible for this billion-dollar profit bleed? Ford’s leadership couldn’t have been clearer: it’s tariffs.

The word “tariffs” was mentioned a staggering 37 times in 55 minutes, once every 89 seconds on the earnings call, as executives detailed the $700 million impact these costs have had on the business. This isn’t a rounding error; it’s a direct, punitive tax that is gutting the company’s profitability.

The proof is in the margin compression.

Table 2: Ford Automotive Margin Compression (Auto EBIT Margin)

| Q3 2025 | Q3 2024 | 9-Mo YTD 2025 | 9-Mo YTD 2024 |

|---|---|---|---|

| 5.1% | 5.5% | 4.1% | 5.9% |

Source: Ford Motor Company Q3 2025 Report

A year-to-date automotive margin of just 4.1% is dangerously thin. It shows that even as Ford sells more cars, it’s making significantly less profit on each one. This is the “Great Squeeze” in action, a narrative we’ve been tracking for months. The company is trapped, and the government’s tariff policies are tightening the vise.

The Canary in Ford Credit

Exploding Loss Provisions

As grim as the tariff story is, it’s not the most alarming piece of data in this report. The true “canary in the coal mine” is hidden deep within the financials of Ford Credit.

On the surface, Ford Credit had a good quarter, with a 16% rise in Earnings Before Taxes (EBT). But this was completely overshadowed by one terrifying number: the Credit Loss Provision. This is the amount of money Ford sets aside in expectation of its customers defaulting on their loans.

That number just exploded.

Table 3: Ford Credit – The Domino Signal

| Metric | Q3 2025 | Q2 2025 |

|---|---|---|

| EBT | $631 Million | $645 Million |

| Credit Loss Provision | $477 Million | $323 Million |

Source: Ford Motor Company Q3 2025 Report

Own It Right.

The ‘M’ is for Maintenance. Find your vehicle’s official factory service schedule.

After reporting $323 million in the Q2 Earnings, Ford just massively increased its provision to $477 million. Almost half a Billion Dollars. This is the most critical signal in the entire report.

This is Ford’s own data confirming the consumer squeeze is worsening. They are seeing clear signs of financial distress in their own loan portfolio and are bracing for a significant wave of defaults. This directly validates our “Domino Effect” and the crises we’ve exposed at First Brands, Tricolor and PrimaLend. The consumer is breaking, and Ford’s own internal data now proves it.

Trapped Between Costs and Consumers

This Q3 report perfectly synthesizes Ford’s strategic dilemma. They are trapped in a classic “Great Squeeze” from two sides.

On one side, they are being crushed by external, non-negotiable costs—namely, the $700 million in tariffs that are destroying their profit margins and forced the guidance cut.

On the other side, the end-consumer is showing clear signs of financial collapse. The exploding loan loss provision is a red-alert warning that the very customers Ford relies on are running out of money.

Revenue is up, showing some demand remains. But that demand is becoming more fragile by the day, while the costs to build each vehicle are being artificially inflated. This is an unsustainable position.

Atrocious Data, Parabolic Market

The facts of this report are simple: Ford’s profits are being gutted by tariffs, forcing a billion-dollar guidance cut. Simultaneously, the company is preparing for a wave of consumer loan defaults. These are not opinions; this is the data.

And how did Wall Street react to this grim operational reality? With irrational euphoria.

Table 4: Ford (F) Stock Market Disconnect

| Date | Event | Stock Price (Close) |

|---|---|---|

| Oct 23 | Pre-Earnings | $12.32 |

| Oct 25 | Post-Earnings | $13.84 |

Source: Market Data

The market, just as it did with GM’s negative report, saw the surface-level revenue beat and sent the stock on a “parabolic” jump, up over 12% in two days.

This is a dangerous and profound disconnect from fundamentals. The market is ignoring the clear, flashing warning signs. The cut guidance proves the “Great Squeeze” on the manufacturer is real, and the exploding loan loss provision proves the consumer is teetering. The fundamental health of both the company and its customer is visibly deteriorating, yet Wall Street is celebrating as if the party is just getting started.

Based in Daytona Beach, Florida, Josh Logan provides data-driven analysis from the unique perspective of a seasoned automotive professional. His goal is to empower consumers with insider knowledge to navigate the complexities of the modern car market.

I appreciate you reading this, and encourage you to engage with me in the comments and on social media. You can get the latest automotive updates as soon as they are published by subscribing above. Thanks for the support, and until next time!

Leave a reply to The Great Tariff Deception (Oct. 26, 2025) – TheLoganZone Cancel reply